When traders talk about higher-yielding currencies, they usually mean those backed by central banks with interest rates above the global average. These currencies can provide attractive opportunities because of the so-called carry trade — borrowing or selling a low-yielding currency to buy one with a higher yield. However, with higher returns often comes higher risk.

In this article, we will explore what higher-yielding currencies are, why traders pay attention to them, and how to approach them wisely.

What Are Higher-Yielding Currencies?

Every central bank sets an interest rate, and these rates strongly influence the currency’s value. A currency with a higher interest rate is called a higher-yielding currency, because traders can potentially earn more by holding it compared to currencies with lower rates.

Examples often include:

- Australian dollar (AUD)

- New Zealand dollar (NZD)

- Emerging-market currencies such as the Brazilian real (BRL), South African rand (ZAR), or Mexican peso (MXN)

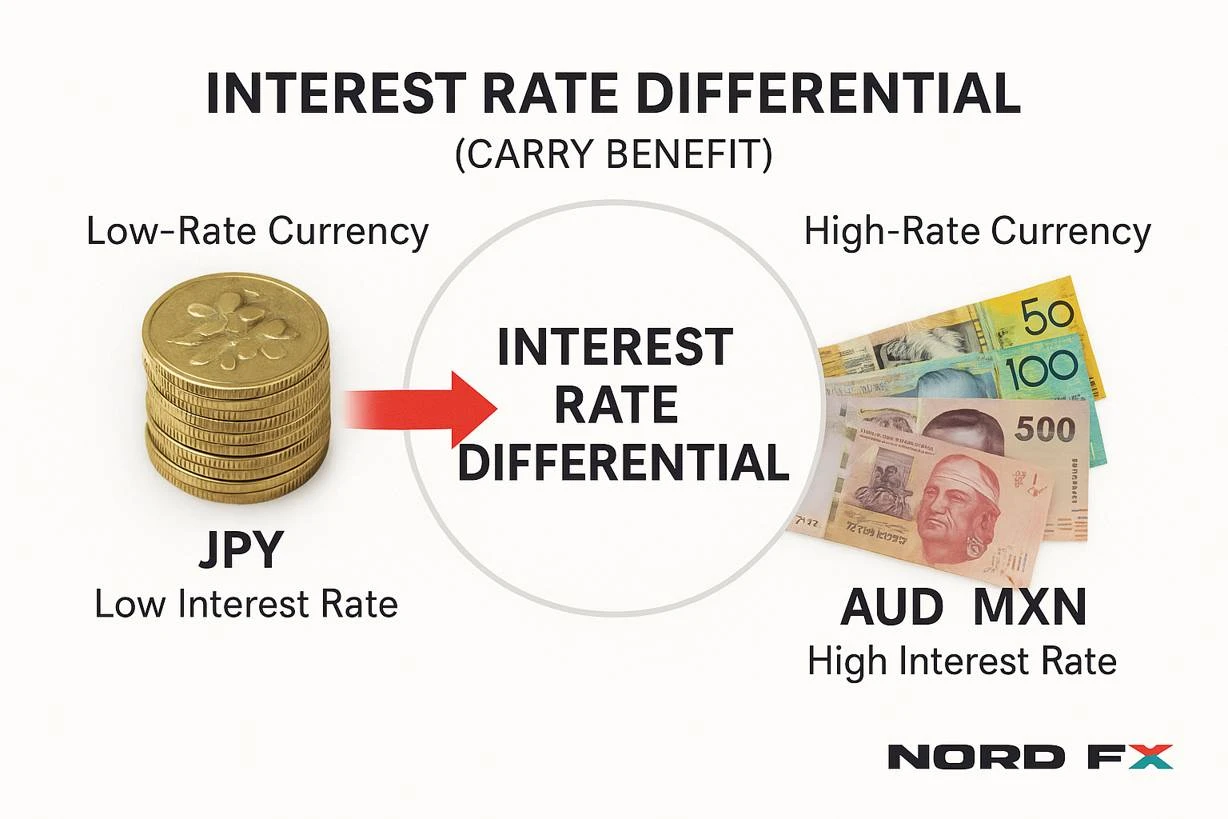

On the other hand, currencies like the Japanese yen (JPY) or Swiss franc (CHF) are considered low-yielding and are often used as funding currencies in carry trades.

Why Do Traders Care About Them?

Carry Trade Potential

Traders may benefit from the difference in interest rates by going long on a high-yield currency and short on a low-yield currency. Over time, this interest differential can add up.

Commodity Links

Many higher-yielding currencies (such as AUD, NZD, ZAR, BRL) are tied to commodities like gold, oil, or agricultural exports. This means their value often moves with global demand for raw materials.

Diversification

Including a higher-yielding currency in a trading strategy can diversify exposure, especially when most developed-market currencies move in similar patterns.

The Risks Behind Higher Yields

While the rewards can be attractive, higher-yielding currencies carry their own set of risks:

Global Risk Sentiment: In times of market stress, investors often rush back into “safe-haven” currencies like USD, JPY, or CHF, causing sharp declines in higher-yielders.

Volatility: Emerging-market currencies are often less liquid and more sensitive to political and economic shocks.

Commodity Dependence: For commodity-linked currencies, a fall in demand or prices can quickly reduce their value.

Policy Changes: Central banks can suddenly raise or cut interest rates, changing the appeal of a currency overnight.

How Traders Can Approach Higher-Yielding Currencies

Match Carefully

Consider pairing a higher-yielding currency with a stable funding currency. For example, AUD/JPY or MXN/JPY are classic carry pairs.

Watch the Fundamentals

Track not only interest rates, but also inflation, growth, and commodity cycles. These factors often determine whether the carry is sustainable.

Use Proper Risk Management

Position sizing is key: avoid overexposure.

Set clear stop-loss levels to guard against sudden reversals.

Remember that carry can build gradually, but losses can come quickly.

Follow Market Sentiment

Carry trades thrive when markets are calm and risk appetite is high. When volatility rises, it’s often safer to reduce exposure to higher-yielders.

Conclusion

Higher-yielding currencies can offer exciting opportunities, especially for traders interested in the carry trade or commodity-driven strategies. However, they also come with increased risks, particularly during periods of global uncertainty.

For retail traders, the best approach is to treat them as a tool in the wider toolkit — useful, but never without careful planning, proper position sizing, and constant awareness of global events. With the right balance of opportunity and caution, higher-yielding currencies can become an important part of a long-term trading strategy.