General Outlook

The past week ended with an unexpected jolt. Late on Friday night, 10 October, when most markets were already asleep, Donald Trump woke everyone up. The U.S. President announced that from 1 November (or even earlier), an additional 100% tariff would be imposed on Chinese imports, on top of existing duties. He also said the U.S. would introduce export restrictions on "all critical software", criticised China’s policy as "hostile", and added that he saw no reason to meet with Chinese leader Xi Jinping.

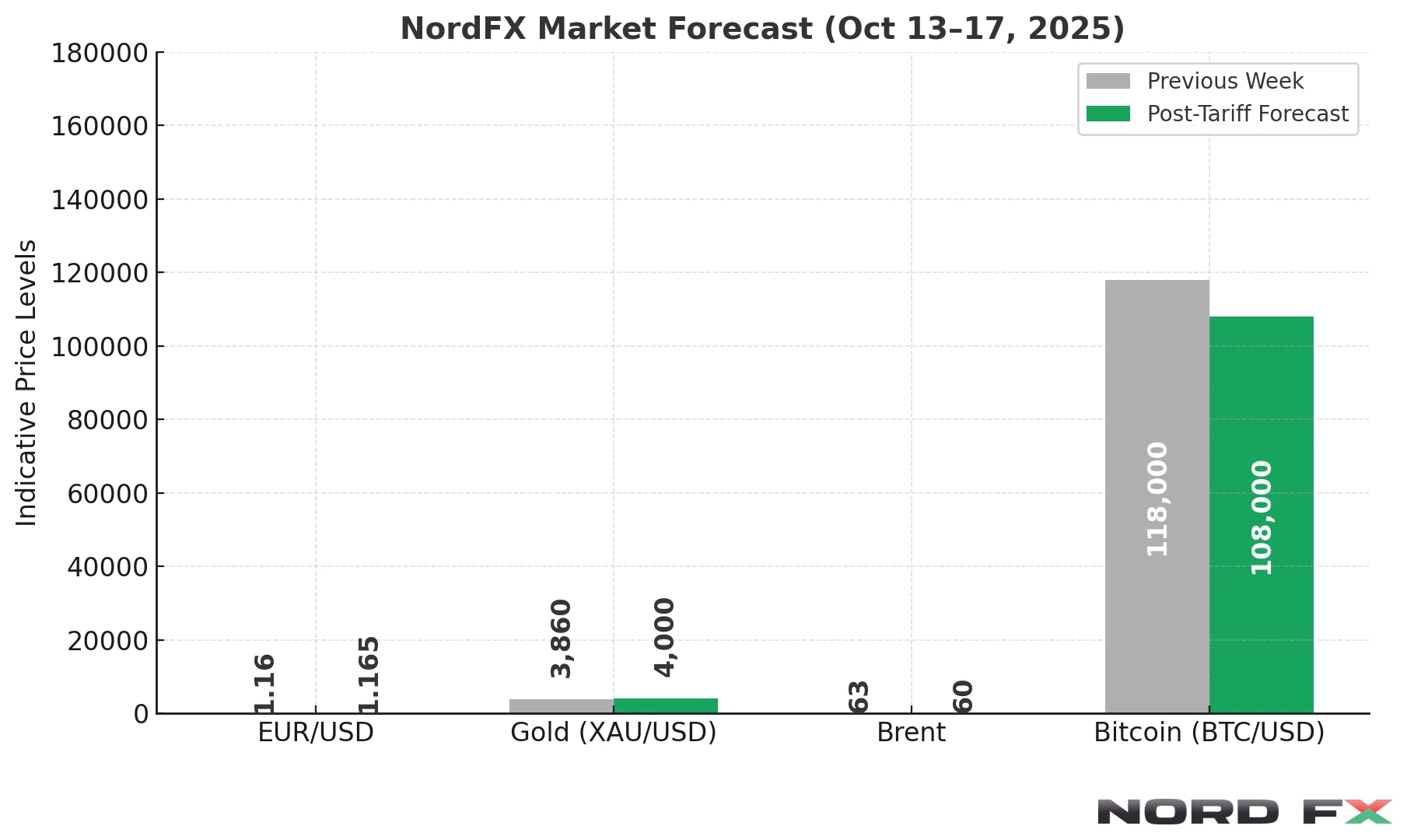

Markets reacted in mixed fashion. The dollar weakened against the euro and gold, while oil, bitcoin, and other cryptocurrencies tumbled.

EUR/USD

The pair rebounded sharply from a low of 1.1541 on Friday to close the week at 1.1622, preserving a fragile medium-term bullish structure. Buyers continue to defend the 1.1550–1.1600 area, though caution dominates as traders await new comments from Trump on tariffs.

Immediate resistance lies at 1.1645, followed by 1.1710–1.1755. A breakout above this zone could push the euro toward 1.1810, with a medium-term target near 1.2000. If the pair falls below 1.1525–1.1550, the path opens toward 1.1400 and, though less likely, 1.1250.

BTC/USD

Bitcoin set yet another all-time high on Monday, 6 October, reaching 126,310 before entering a soft correction. On Friday, following Trump’s announcement, the price plunged to 103,720, but panic soon subsided and the main cryptocurrency recovered above the strong support/resistance area near 112,000.

Institutional demand and ETF inflows continue to underpin the longer-term uptrend. The nearest upside targets are at 128,000–132,000, and if momentum holds, growth toward 137,000 remains possible. Support levels are at 117,000 and 114,000; a break below 110,000 could trigger a deeper correction to 107,000.

Brent

Brent crude closed the week at 62.06 per barrel. As forecast in the previous review, if bears managed to hold the price below the key 64.80–65.00 support area, it would turn into resistance, opening the way to 62.50–63.00 – exactly what happened.

Trump’s statements have amplified fears of a cooling Chinese economy, giving sellers additional momentum. For now, buyers face the task of reclaiming the 64.80–65.00 zone. Talk of a rally toward 68.50–70.00 is premature, though not impossible. The evolution of the tariff situation will play a decisive role in shaping demand expectations for energy commodities.

Technically, the picture remains bearish, and a move below 62.00 could push prices toward 58.00 or even 53.50.

XAU/USD (Gold)

In last week’s forecast, we expected gold to test the 4,000 level in the very near term, and the prediction proved 100% accurate. On 8 October, the metal reached 4,059, then pulled back slightly to close the week at 4,010.

Expectations of further Fed policy easing and the overall global uncertainty continue to support demand. A short-term correction to 3,765–3,900 remains possible, followed by renewed growth toward 4,200–4,465. A sustained move above 4,100 would confirm the continuation of the bullish trend, as investors still view gold as the primary safe-haven asset.

Conclusion

The week of October 13–17 opens under the influence of Trump’s surprise tariff announcement. The dollar has lost part of its defensive appeal, while gold and the euro are regaining strength. Bitcoin and oil remain under pressure but are attempting to stabilise after Friday’s shock.

Gold continues to look strongest among safe-haven assets, while Brent’s outlook stays bearish amid fears of weaker Chinese demand. The euro’s resilience will depend on further U.S. rhetoric, and bitcoin’s recovery potential hinges on renewed institutional inflows. Volatility is likely to stay high across all major markets as traders assess the real economic impact of the new tariffs.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.