Understanding Slippage in Trading

When you place a trade, you expect it to be executed at a certain price. But sometimes, what you get is something entirely different—better or worse. That tiny ...

Read More

When you place a trade, you expect it to be executed at a certain price. But sometimes, what you get is something entirely different—better or worse. That tiny ...

Read More

The foreign exchange market, or forex, is the largest financial market in the world. Among the thousands of currency pairs traded daily, one pair dominates all ...

Read More

In the fast-moving world of financial markets, few forces are more powerful — or more dangerous — than emotion. One emotion in particular has taken center stage ...

Read More

In the world of price action trading, few patterns are as iconic and effective as the pin bar. Simple in appearance yet deeply revealing in meaning, the pin bar ...

Read More

If you're just starting your forex trading journey, you've probably come across the term major forex pairs. These pairs dominate the trading world, and for good ...

Read More

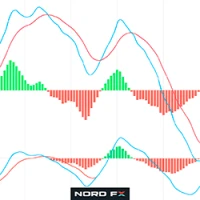

The MACD (Moving Average Convergence Divergence) is one of the most widely used tools in technical analysis, valued for its ability to combine trend-following a ...

Read More

In fast-moving financial markets, success often hinges on understanding more than just price charts. One crucial yet sometimes overlooked tool is market depth. ...

Read More

The Relative Strength Index (RSI) remains one of the cornerstone indicators for traders seeking to measure market momentum. Originally developed by J. Welles Wi ...

Read More

Divergence in trading is one of the most valuable concepts in technical analysis. For intermediate traders looking to refine their market entries and exits, rec ...

Read More

In the ever-evolving world of financial markets, timing is everything. Among the various trading strategies available, momentum trading has carved out a signifi ...

Read More