The past week was marked by strong growth in both traditional and digital assets. The euro demonstrated notable strengthening against the dollar, gold continued to climb aggressively, and bitcoin maintained its position within a bullish channel. As we move into the coming week, investors should be prepared for potential corrections across all three instruments, followed by renewed attempts at growth or continued trends depending on key technical levels.

EUR/USD

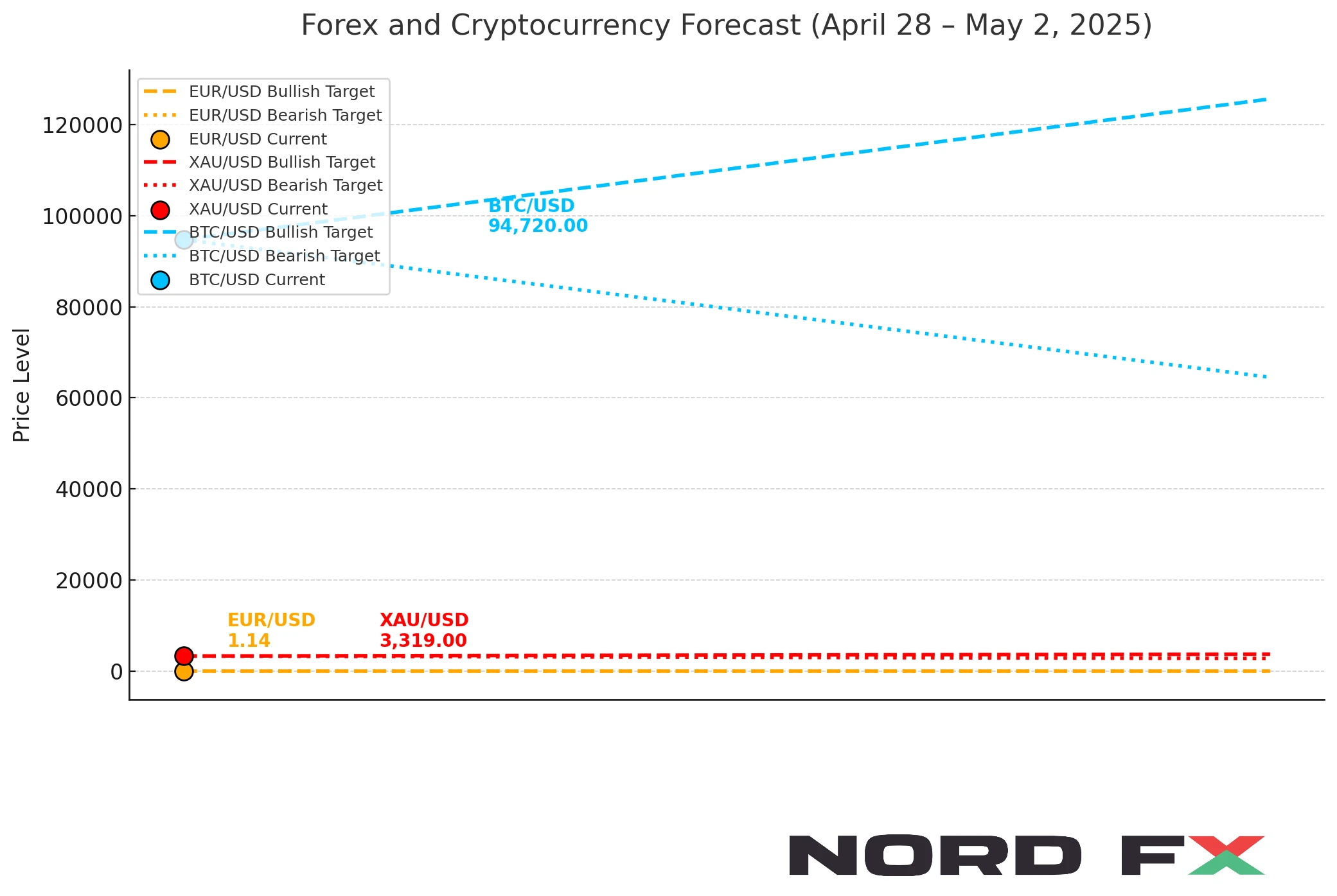

The EUR/USD currency pair ended the previous trading week with confident gains, closing near 1.1364. Moving averages indicate the formation of a bullish trend, with prices having broken through the area between the signal lines upwards, confirming the buyers’ pressure on the European currency. In the coming week, an attempt to continue the bullish correction is expected, with quotes likely to test the resistance area around 1.1525. However, from this level, a downward rebound is anticipated, followed by a continuation of the pair’s decline towards the area below 1.0795.

An additional signal supporting a decline in EUR/USD would be a test of the resistance line on the relative strength indicator (RSI), alongside a possible rebound from the upper boundary of the bullish channel. A cancellation of the downward scenario would require strong growth and a breakout above 1.1765, which would open the way for a further rise towards the 1.1995 level. On the downside, confirmation of continued weakening would come if quotes break and close below 1.1205, signalling a breakout of the bullish correction channel’s lower border.

XAU/USD

Gold ended the trading week with sharp gains, closing near the 3319 area. XAU/USD continues to move within a correction and a bullish channel, with moving averages pointing to the preservation of the upward trend. Buyers have successfully pushed prices upwards through the area between the signal lines, reinforcing expectations of further growth. In the early part of the new week, a bearish correction could develop, with a likely test of the support level near 3195. After this, a rebound is expected, followed by continued growth towards a potential target above 3745.

A further signal favouring continued growth would be a rebound from the trend line on the RSI, as well as a bounce from the lower boundary of the bullish channel. A cancellation of the growth scenario would require a fall and a breakout below the 3145 area, which would indicate a breakdown of the bullish channel’s lower boundary and a potential decline in gold prices towards 2775. Confirmation of renewed growth will be provided by a breakout above the resistance area and the closing of quotes above 3425.

BTC/USD

Bitcoin finished the trading week at the 94720 level, continuing its movement within a well-defined bullish channel. Moving averages confirm the presence of an upward trend, with prices breaking through the area between the signal lines, highlighting strong demand from buyers. In the short term, a bearish correction is possible, with a test of the support area near 87305 anticipated. From this zone, an upward rebound is expected, leading to a potential continuation of the rise towards 125605.

An additional signal favouring bitcoin’s growth will be a rebound from the bullish channel’s lower boundary, supported by a test of the support line on the RSI. The growth scenario could be cancelled if BTC/USD falls and breaks through the 72565 level, which would suggest a further decline towards 64505. A breakout above the resistance area and a closing of quotes above 98505 will confirm the continuation of the bullish trend.

Conclusion

The overall market picture remains tilted towards bullish trends for the euro, gold, and bitcoin, although the coming days may bring corrective movements as part of broader upward structures. Key resistance and support levels will play a decisive role in determining whether the corrections are short-lived or signal a deeper reversal. Traders should remain alert to breakouts of major technical boundaries, which will offer clearer signals for the further development of trends during the week from April 28 to May 2, 2025.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.