The final days of the first week of June brought mixed results across financial markets. The EUR/USD pair slipped slightly, while gold corrected lower, and bitcoin managed to close the week in positive territory. Market sentiment remains cautious as traders weigh inflation data, central bank expectations, and geopolitical uncertainties. The coming week could see increased volatility as technical patterns approach critical levels.

EUR/USD

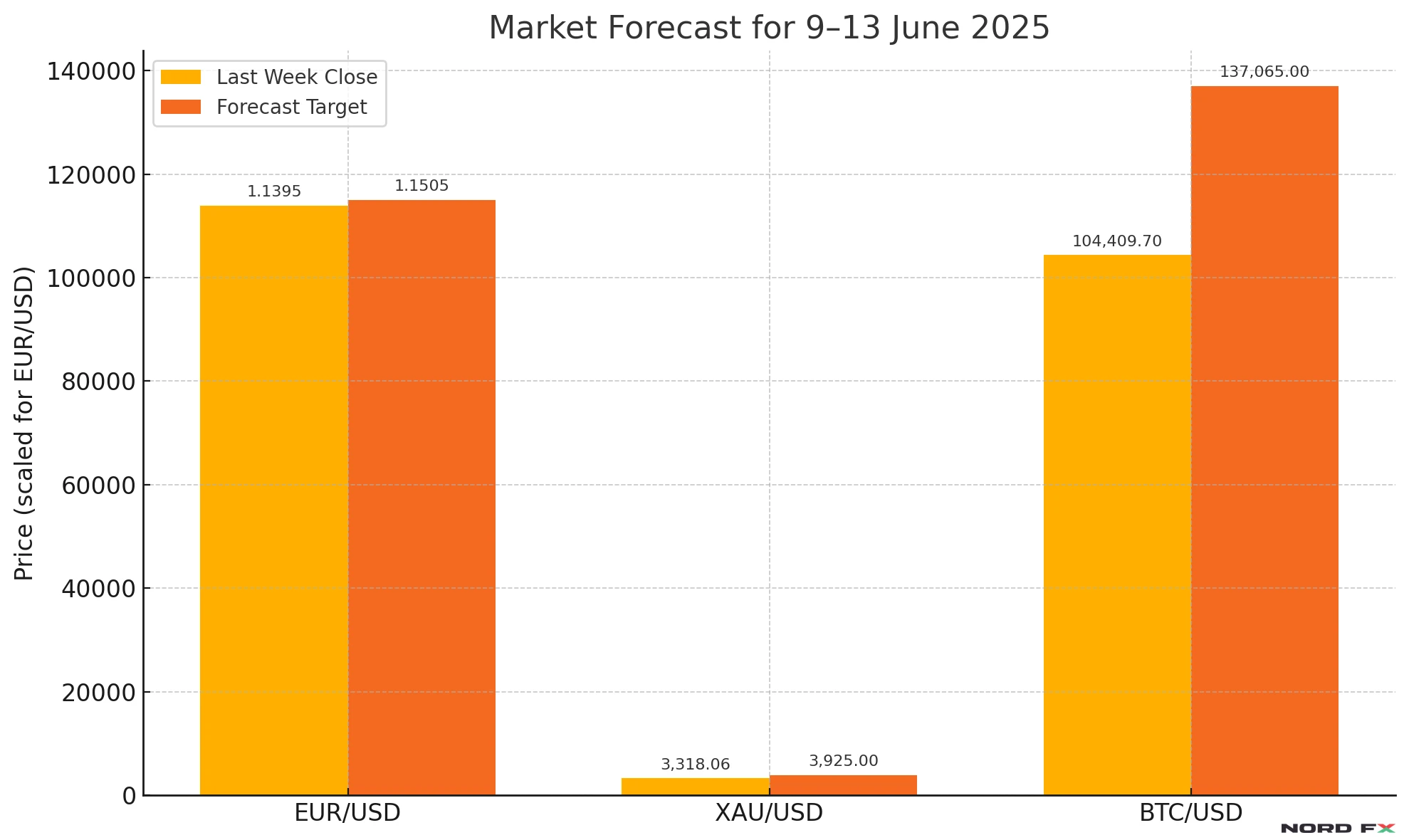

The EUR/USD pair ended last week at 1.1395, reflecting a moderate pullback. Despite the decline, moving averages still point to a bullish trend, and the pair remains above key technical supports. A test of resistance near the 1.1505 level is likely, after which a downward rebound may develop. Should the pair break below 1.1105, a more sustained decline could unfold, potentially targeting levels below 1.0785. The presence of a “Double Top” pattern and a test of the RSI resistance trendline adds further weight to the correction scenario. On the flip side, a sharp rise and a breakout above 1.1775 would invalidate this outlook and open the way towards 1.2165.

XAU/USD

Gold prices closed the week at 3,318.06, marking a retracement from recent highs. The metal continues to trade within a bullish channel, but short-term weakness suggests a potential test of support near the 3,275 area. If prices rebound from this level, upward momentum may resume with a target near 3,925. A breakdown below 3,045, however, would signal a shift in sentiment and possibly accelerate the fall towards the 2,785 area. Technical indicators show that a test of the trendline on the RSI could support a continuation of the broader uptrend, but caution remains warranted in the short term.

BTC/USD

Bitcoin closed the week at 104,409.70, maintaining its position within a bullish corrective channel. After recent gains, a minor pullback towards the 91,505 level is possible, where support may trigger renewed buying interest. If this scenario plays out, BTC/USD could resume its climb towards 137,065. Technical support from the RSI trendline and lower boundary of the channel lends credibility to the bullish case. A drop below 85,605 would negate this scenario and expose the cryptocurrency to further losses, with 77,445 acting as the next key support.

Conclusion

The new trading week presents a split landscape. The euro and gold are showing signs of short-term weakness within a longer-term bullish structure, while bitcoin remains technically strong above key support. With central bank decisions and inflation expectations in focus, traders should watch for confirmation of breakouts or reversals at the critical levels outlined above.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.