General Outlook

With August CPI at +2.9% y/y (matching forecasts) but +0.4% m/m (a touch hot), and the ECB holding steady on 11 September, the dollar (DXY ~97.6) remains soft into a pivotal FOMC (16–17 Sep) and BoE (18 Sep). Preliminary U. Michigan sentiment slipped to 55.4 on Friday, underscoring a fragile consumer backdrop.

EUR/USD

The pair ended the week around 1.173–1.174 as the ECB kept policy unchanged and the dollar drifted. Into the Fed/BoE, the near-term tone is mildly constructive while the market prices a 25 bp Fed cut.

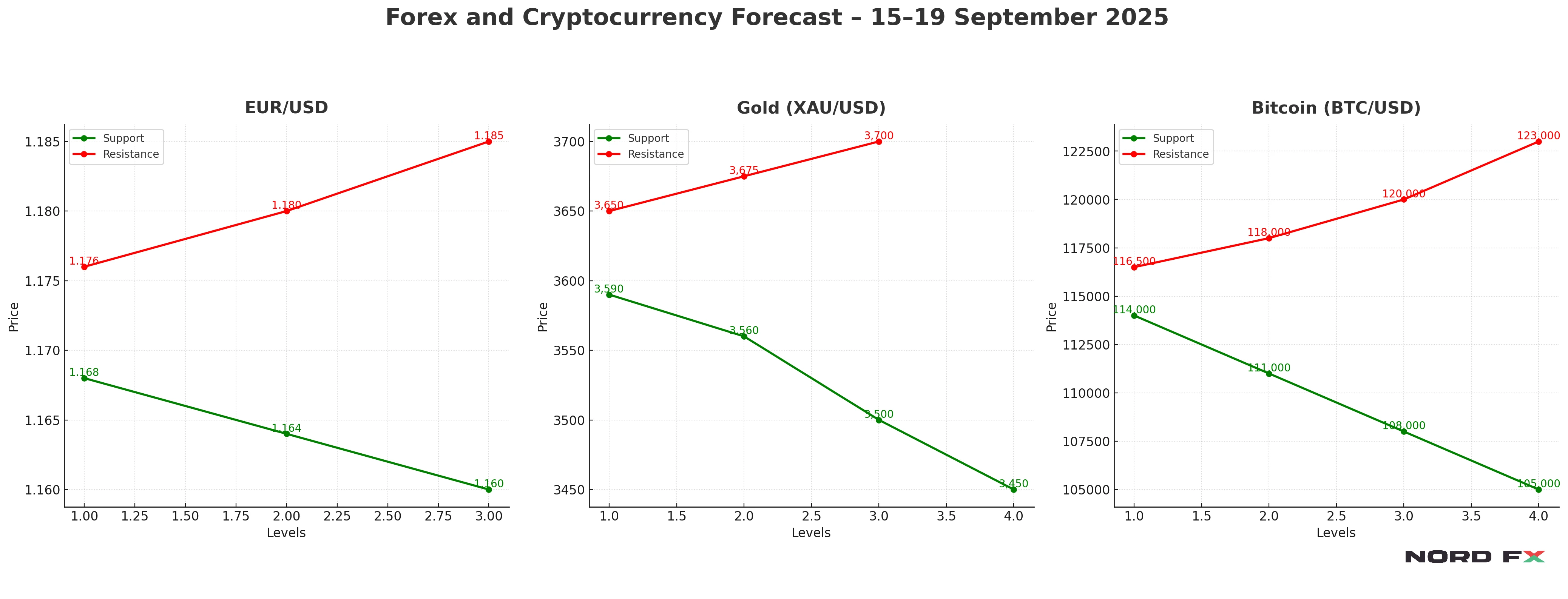

- Resistance: 1.1760–1.1800, then 1.1850.

- Support: 1.1680–1.1640, then 1.1600.

- Trading view: Prefer buying shallow dips while above 1.1640, targeting 1.1800/1.1850. A less-dovish-than-priced Fed could prompt a pullback to 1.1640–1.1600.

XAU/USD (Gold)

Spot gold closed Friday near $3,643/oz, holding just shy of record territory as yields and the dollar stay tame ahead of the FOMC. Positioning is rich, so the metal is sensitive to the dots and Powell’s tone.

- Resistance: $3,650–3,675, then $3,700.

- Support: $3,590–3,560, then $3,500–3,450.

- Trading view: Buy-the-dip bias above $3,560–3,590 for a re-test of $3,675–3,700; a hawkish surprise risks a correction towards $3,500–3,450.

BTC/USD

Bitcoin reclaimed $115k+ into the weekend as macro stayed supportive and risk appetite improved. A benign Fed outcome favours continuation; tighter guidance could sap momentum.

- Resistance: $116.5k, then $118–120k ($123k beyond).

- Support: $114k–$111k, then $108k–$105k.

- Trading view: Mildly bullish while above $111k–$114k, aiming for $118–$120k; watch the post-FOMC dollar/yields reaction for direction.

Conclusion

For 15–19 September, EUR/USD keeps a slight upside tilt while the dollar is soft; gold is underpinned near highs; bitcoin stays constructive above $111k–$114k. The FOMC (16–17 Sep) is the key catalyst, followed by the BoE (18 Sep). A clearly dovish Fed would support EUR, bullion, and crypto; a guarded message could spark a dollar bounce and shallow corrections.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.