General Outlook

With the Fed cutting the funds rate by 25 bps on 17 September to 4.00–4.25% (11–1 vote; Miran dissented for a 50 bps cut) and the BoE on 18 September holding Bank Rate at 4% while slowing QT to £70bn over the next 12 months (target £488bn stock), the dollar stays soft into a data-heavy week. The ECB left policy unchanged on 11 September (DFR 2.00%, MRO 2.15%, MLF 2.40%). Flash PMIs arrive Tuesday, 23 September, followed by the US Q2 GDP (third estimate) and August durable goods on Thursday, 25 September.

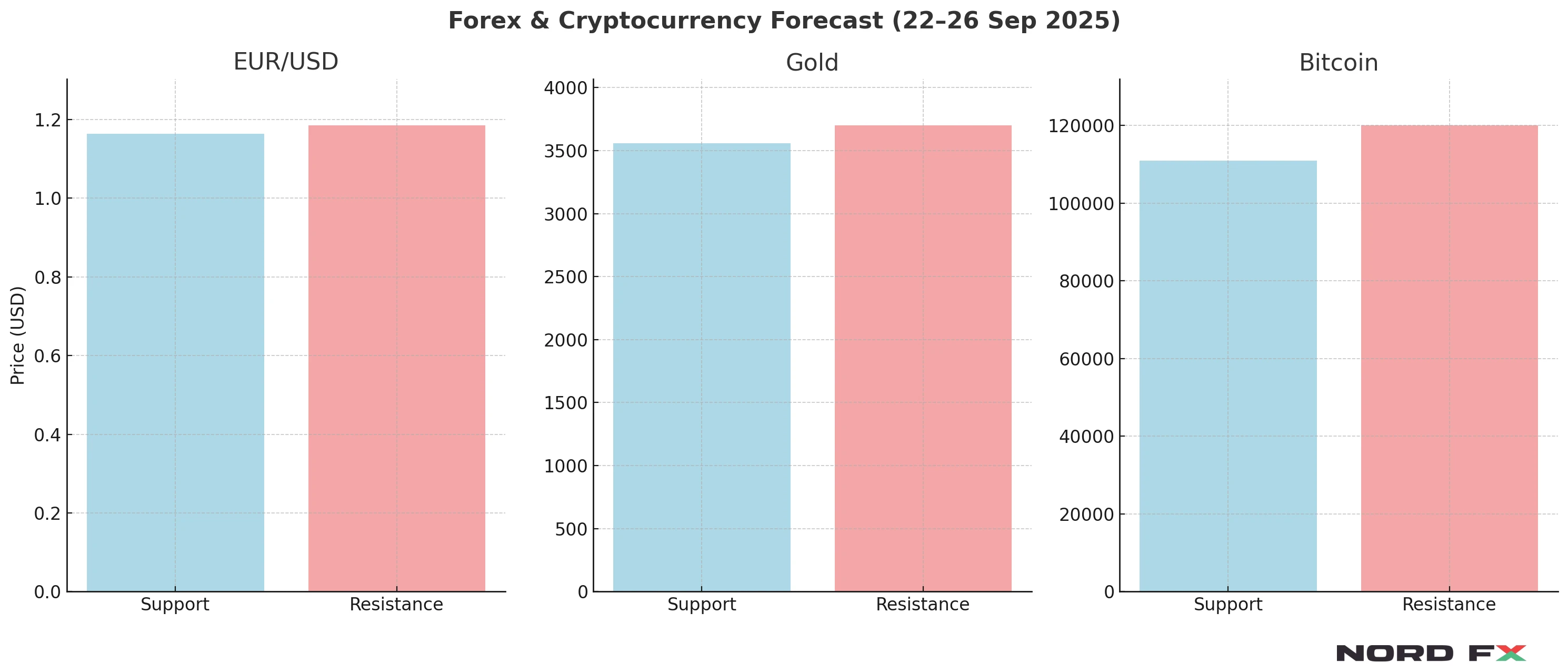

EUR/USD

The pair ended last week near 1.1745 (Friday close), having traded in a 1.173–1.192 band around the FOMC and BoE headlines. A benign PMI round and in-line GDP should keep the near-term bias modestly EUR-positive; stronger-than-expected US data risks a pullback. Resistance is at 1.1760–1.1800, then 1.1850–1.1900. Support is at 1.1680–1.1640, then 1.1600. Trading view: prefer buying shallow dips while above 1.1640, targeting 1.1800/1.1850; a hot US data surprise could drag price back towards 1.1640–1.1600.

XAU/USD (Gold)

Spot gold closed Friday around $3,680/oz (day range roughly $3,632–3,686). With real yields contained and the dollar soft post-FOMC, dips remain shallow ahead of Tuesday PMIs and Thursday’s GDP and durable goods. Positioning is rich, so the metal is sensitive to upside US surprises. Resistance is at $3,650–3,675, then $3,700. Support is at $3,590–3,560, then $3,500–3,450. Trading view: maintain buy-the-dip bias above $3,560–3,590 for a re-test of $3,675–3,700; a hotter data run risks a correction towards $3,500–3,450.

BTC/USD

Bitcoin is consolidating above $115k–$116k after briefly touching around $117.9k on 18 September; macro remains a tailwind if US data don’t push yields decisively higher. A clean break above $118k opens $120k and potentially $123k. Resistance is at $116.5k, then $118–120k ($123k beyond). Support is at $114k–$111k, then $108k–$105k. Trading view: mildly bullish while above $111k–$114k, aiming for $118–$120k; watch Tuesday’s PMI risk and Thursday’s GDP and durable goods for directional cues.

Key Dates

Tuesday, 23 September: Flash PMIs (Eurozone, UK, US)

Thursday, 25 September: US Q2 GDP (third estimate) and US Durable Goods Orders (August, advance)

Conclusion

For 22–25 September, EUR/USD retains a slight upside tilt with the dollar soft; gold stays underpinned near highs; bitcoin remains constructive above $111k–$114k. A notably stronger US data pulse would favour a dollar bounce and shallow corrections in bullion and crypto; benign prints keep the current trend intact.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back