Markets enter the new trading week with sentiment shaped almost entirely by expectations surrounding the Federal Reserve’s 9–10 December policy meeting. A 25 bp cut remains the dominant scenario priced into rates markets, and investors are increasingly positioned for further policy easing in early 2026. This has restrained the US dollar, kept yields heavy and sustained interest in defensive assets such as gold, while risk markets oscillate in narrow ranges pending clearer guidance. EUR/USD closed the week at 1.1643, Brent settled around 63.75 dollars per barrel, Bitcoin ended Friday near 89,300 dollars, and gold finished near 4,196 after testing higher intraday levels.

EUR/USD

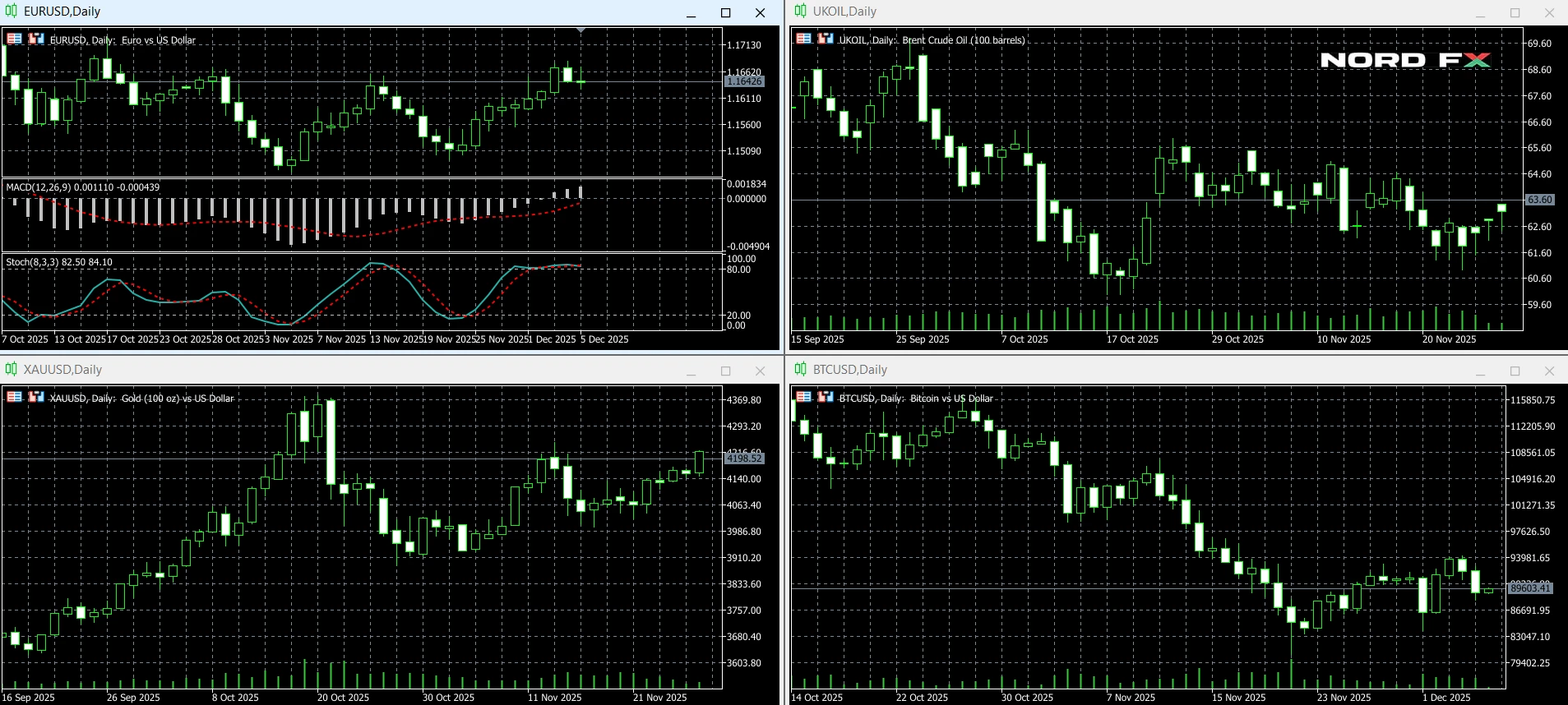

The euro remains supported by softer US data momentum and declining Treasury yields, with the pair consolidating above mid-November lows. Trading on Friday held within 1.1628–1.1672 before settling at 1.1643. Investors appear reluctant to add short-dollar exposure ahead of the Fed, but dips in the pair continue to attract buying as long as rate-cut expectations remain intact. Immediate support stands at 1.1580–1.1550, followed by 1.1520–1.1490 and then 1.1400–1.1365. Initial resistance is concentrated at 1.1660–1.1700, with 1.1760–1.1800 as the next upside barrier. A daily close above 1.1800 would confirm continued bullish structure, opening 1.20–1.22 if the Fed leans dovish.

Baseline view: neutral with a moderately constructive bias while the pair holds above 1.1520–1.1490.

Bitcoin (BTC/USD)

Bitcoin remains in a stabilisation phase after its sharp October–November correction. The recovery above 92,000 earlier in the week lacked follow-through and gave way to renewed selling, leaving BTC/USD near 89,300 at Friday’s close and around 89,600 in weekend trading. The market remains split between profit-takers and long-term buyers, while ETF capital flows have lost some momentum. Key support lies at 88,000–86,000, then 84,000–82,000. A decisive break would expose 80,000–78,000 and potentially extend towards 76,000–72,000 if sentiment deteriorates. Initial resistance is at 92,000–95,000, with a more meaningful reversal signal only if the market can hold above 100,000–105,000.

Baseline view: neutral to slightly bearish while Bitcoin stays capped below 92,000–95,000.

Brent Crude Oil

Brent is trading inside a controlled but downward-leaning structure. Friday’s session saw a 63.06–64.09 range and a close near 63.75, signalling balanced positioning between supply uncertainty and demand caution. Expectations of extended OPEC+ discipline provide a floor, but concerns over non-OPEC output and uneven global growth continue to limit upside traction. The nearest support is located at 61.5–61.0, with a break targeting 59.0–57.5 and signalling renewed downside momentum. Resistance stands at 64.5–65.5, then 67.5–68.5, an area still likely to attract selling unless demand indicators strengthen. A daily close above 68.5 would suggest improving market confidence and open the way toward the low-70s.

Baseline view: neutral to mildly bearish while Brent trades below 67.5–68.5.

Gold (XAU/USD)

Gold continues to outperform into year end as expectations of lower real yields and policy easing dominate positioning. The metal briefly traded above 4,250 before moderating into a 4,192–4,259 band on Friday and finishing near 4,196. Dips remain shallow and met with renewed interest, reflecting flows towards hedging, duration and systemic risk aversion. Initial support lies at 4,180–4,150, with further levels at 4,120–4,080 and 4,020–3,980. The broader uptrend remains intact while price trades above 4,000–3,950. Resistance is concentrated at 4,260–4,280, where a breakout would open 4,320–4,350.

Baseline view: buy on dips while gold holds above 4,000–3,950.

Conclusion

The week of 8–12 December begins under the shadow of a pivotal Fed decision. EUR/USD remains supported as softer yields weigh on the dollar, but confirmation of direction depends on how the Fed communicates the path ahead. Bitcoin is stabilising but lacks the recovery impulse seen earlier in the year. Brent trades defensively in a supply-versus-demand stalemate. Gold retains leadership as markets hedge against policy shifts and uncertainty. Volatility may rise around mid-week, and positioning is likely to adjust rapidly if the Fed surprises on tone or forward guidance. Traders should monitor support and resistance areas closely and adjust risk accordingly.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.