The past week has been marked by significant volatility across the forex and cryptocurrency markets. The euro continued its downward trajectory against the US dollar, influenced by persistent bearish pressure. Meanwhile, gold prices showed resilience, maintaining their upward momentum within a bullish trend. Bitcoin demonstrated strong growth, testing key resistance levels, though it remains susceptible to short-term corrections. The upcoming trading week is expected to bring heightened activity, with key technical levels playing a pivotal role in shaping market directions.

EUR/USD

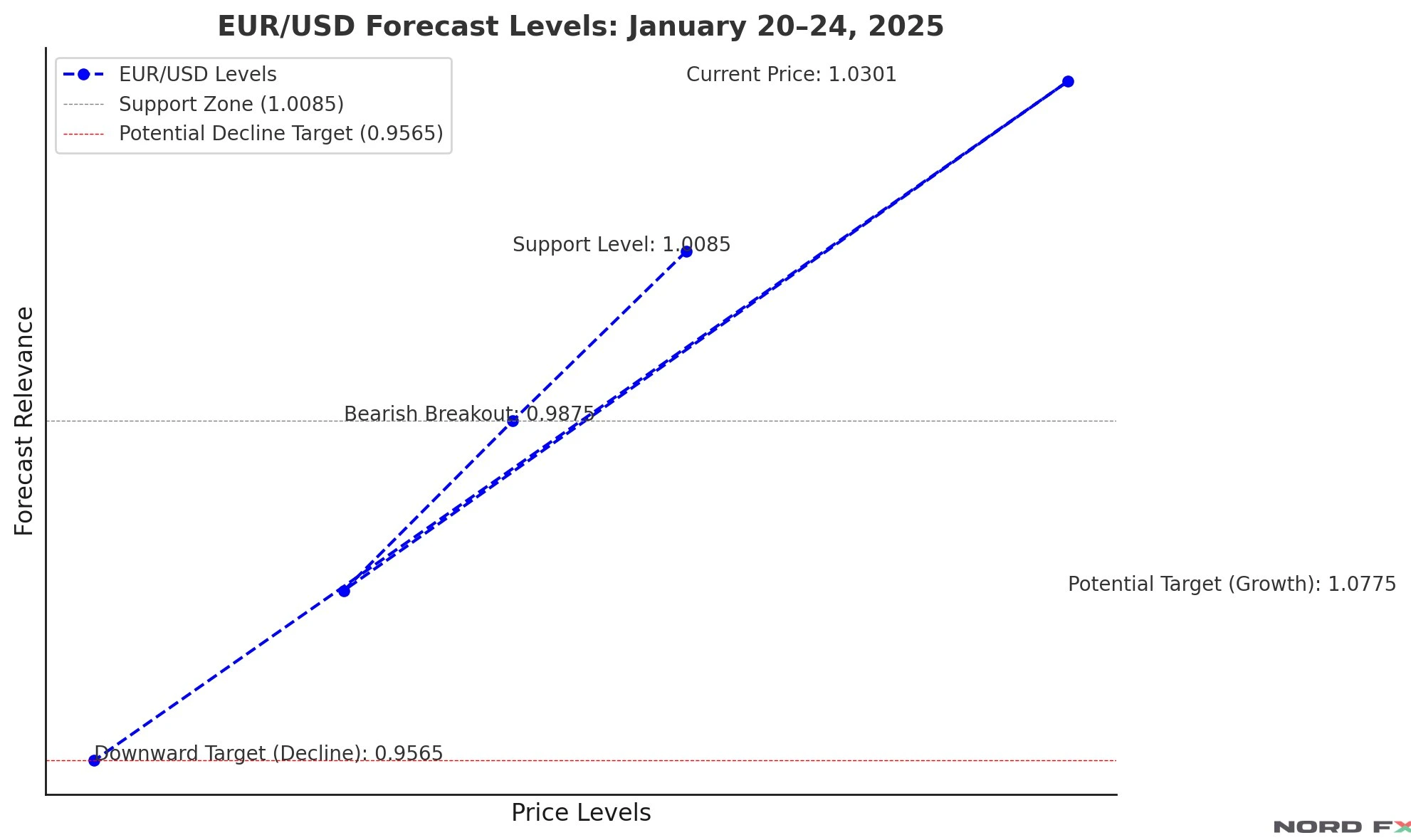

The EUR/USD currency pair ended the previous week at 1.0301, continuing its movement within a descending channel. The bearish trend remains intact, as indicated by the moving averages, with sellers maintaining pressure. The pair has broken through the signal lines, suggesting the potential for further declines. A key level to watch is 1.0085, which may act as a support zone. A rebound from this level could lead to renewed growth, with the pair targeting 1.0775 in the near term.

Additional confirmation for a bullish rebound comes from the RSI indicator, which is testing the support line. However, if the pair falls below 0.9875, this scenario would be invalidated, potentially triggering a deeper decline toward 0.9565. Conversely, a breakout above 1.0485 would indicate a breach of the descending channel, paving the way for a sustained recovery.

XAU/USD

Gold prices concluded last week with growth near the 2706 level, maintaining their bullish momentum. The formation of a "Triangle" pattern on the chart signals potential for continued upward movement. Moving averages point to a strong uptrend, although short-term corrections cannot be ruled out.

In the coming week, gold is likely to test support near 2675, where a rebound could lead to further gains, targeting 3025. RSI support and a bounce from the "Triangle" pattern's upper boundary add credibility to this scenario. However, a decline below 2495 would invalidate the bullish outlook, potentially driving prices down to 2425. A breakout above 2745 would confirm the continuation of the upward trend, marking the implementation of the "Triangle" pattern.

BTC/USD

Bitcoin ended last week at 102,181, maintaining its position within a bullish channel. Moving averages confirm an uptrend, with prices breaking above signal lines. Despite the bullish backdrop, a pullback toward the 94,505 support level is possible in the short term. A rebound from this area could propel bitcoin higher, with the next target set above 126,605.

Support from the RSI trend line and a bounce from the lower boundary of the bullish channel reinforce this upward scenario. However, a break below 80,705 would negate this outlook, opening the door for further declines toward 70,155. Conversely, a breakout above 150,605 would validate the continuation of bitcoin’s bullish rally.

The trading week of January 20–24, 2025, presents a mixed picture for forex and cryptocurrency markets. The euro remains under bearish pressure, with critical support levels likely to determine its next move. Gold is poised for continued growth, driven by bullish technical patterns, while bitcoin holds strong within its uptrend despite the risk of short-term corrections. Traders should monitor key technical levels closely, as these will be instrumental in shaping market dynamics over the coming days.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back