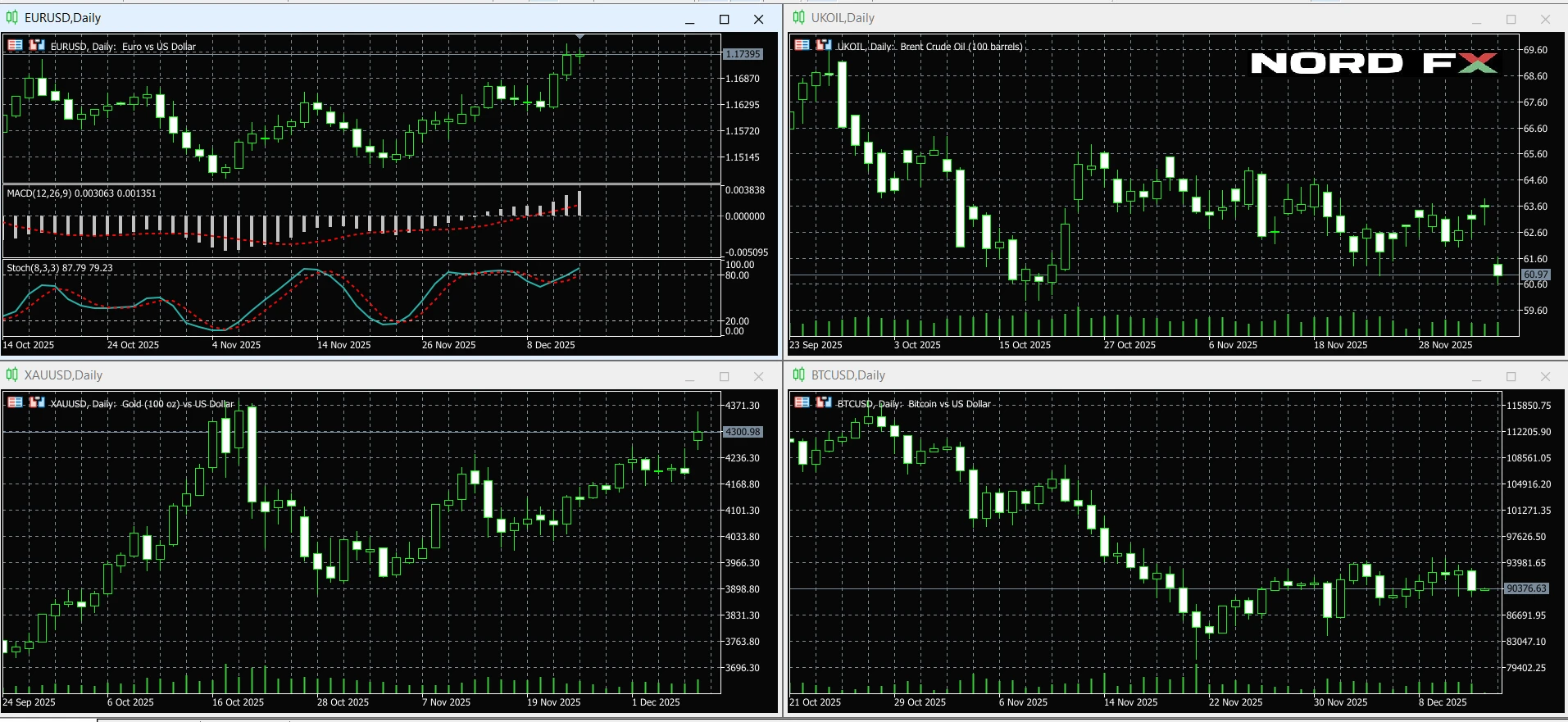

The past trading week ended under the influence of the Federal Reserve’s December rate decision and changing expectations regarding global monetary policy. Market participants are now shifting focus to upcoming macroeconomic data releases and the Bank of Japan’s policy meeting scheduled for 18-19 December. By the close of trading on Friday, 12 December, EUR/USD was trading near 1.1740, Brent crude oil finished around 61.1 dollars per barrel, bitcoin consolidated in the 90,000-92,000 range, while gold closed at 4,328.30.

EUR/USD

The EUR/USD currency pair is ending the trading week with growth near 1.1740. Moving averages indicate a moderately bullish trend for the pair. Prices remain above key support levels, suggesting continued pressure from buyers of the European currency and the potential for further upward attempts from current levels.

As part of the EUR/USD forecast for the trading week, an attempt to continue growth and test the resistance area near 1.1800-1.1840 is expected. From this zone, a corrective pullback may develop, with a possible continuation of the decline toward the support area near 1.1700-1.1680. A deeper correction could extend toward 1.1620-1.1580.

An additional signal favouring a correction in the EUR/USD pair will be a test of the resistance line on the relative strength indicator (RSI). A strong rally and a breakout above 1.1900 would cancel the correction scenario and indicate a breakout of resistance with further growth toward 1.2000. A breakdown and consolidation below 1.1520 would confirm the development of a more pronounced bearish movement.

Baseline view: neutral to moderately bullish while EUR/USD remains above 1.1680.

Bitcoin (BTC/USD)

Bitcoin BTC/USD is ending the trading week consolidating in the 90,000-92,000 area. Moving averages indicate a cautious to slightly bearish trend, with prices struggling to regain upside momentum as the market approaches the year-end period.

As part of the Bitcoin forecast for the trading week, an attempt at a bullish correction and a test of the resistance area near 92,000-95,000 should be expected. From this zone, a downward rebound and a continuation of the decline remain possible, with downside targets near 90,000-89,000 and further toward 88,000-86,000.

An additional signal favouring a decline in BTC/USD quotes will be a rebound from the resistance line on the relative strength indicator (RSI). A strong rally and a breakout above the 100,000-105,000 area would cancel the bearish scenario and indicate renewed growth with higher upside targets.

Baseline view: neutral to slightly bearish while BTC/USD remains below 95,000.

Brent Crude Oil

Brent crude oil prices are ending the trading week near 61.1 dollars per barrel. Moving averages indicate a bearish trend, with prices remaining under pressure amid persistent demand concerns.

As part of the Brent forecast for the upcoming trading week, an attempt at a bullish correction and a test of the resistance area near 62.5-63.5 should be expected. From this area, a downward rebound and a continuation of the decline toward the support zone near 60.5-60.0 may follow. A breakdown below 57.5 would confirm the development of a stronger bearish trend.

An additional signal favouring a decline in oil prices will be a test of the resistance line on the relative strength indicator (RSI). A strong rise and a breakout above 65.5 would cancel the bearish scenario and indicate a breakout of resistance with further recovery toward the upper 60s.

Baseline view: neutral to mildly bearish while Brent remains below 63.5-65.5.

Gold (XAU/USD)

Gold XAU/USD is ending the trading week with strong growth near 4,328.30. The asset continues to move within a bullish channel. Moving averages confirm a stable uptrend, with prices holding above key support levels and reflecting sustained buying interest.

As part of the gold price forecast for the trading week, an attempt at a short-term bearish correction and a test of the support area near 4,280-4,250 should be expected. From this zone, an upward rebound and a continuation of growth toward the resistance area near 4,350-4,380 are likely. A breakout above this zone would open the way toward the 4,400 area.

An additional signal favouring growth in gold prices will be a rebound from the bullish trend line on the relative strength indicator (RSI). A decline and a breakout below the 4,200-4,160 area would cancel the bullish scenario and indicate the risk of a deeper correction.

Baseline view: buy on dips while gold remains above 4,200-4,160.

Conclusion

The week of 15-19 December is expected to remain driven by post-Fed positioning, key macroeconomic data releases, and the Bank of Japan’s policy decision. EUR/USD retains a constructive tone but remains sensitive to US economic indicators. Bitcoin continues to trade in a wide consolidation range with elevated volatility risks. Brent crude oil remains under pressure due to demand concerns. Gold continues to outperform, supported by expectations of easier monetary policy and strong safe-haven demand.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.