The SMC trading strategy has become one of the most discussed approaches in modern forex and CFD trading. Many traders are drawn to it because it focuses on how large institutional players influence price rather than relying only on indicators. Understanding how smart money operates can help traders read price action with more structure and clarity.

This article explains the SMC trading strategy from the ground up. It covers the core concepts, how to identify them on a chart, and how traders apply them in real market conditions, while keeping the approach educational and practical.

The SMC trading strategy is a methodology based on the idea that institutional participants drive market movements through liquidity, market structure, and order execution. Traders using this approach aim to align their trades with these large players by identifying key price zones such as order blocks, liquidity pools, and structural shifts.

Key points:

- SMC focuses on institutional behavior, not indicators

- Market structure is central to trade direction

- Liquidity explains many sharp price movements

- Risk management remains essential even with SMC

- SMC is a framework, not a guaranteed system

What Is the SMC Trading Strategy?

The SMC trading strategy is based on the Smart Money Concept, which assumes that large institutions such as banks, hedge funds, and major financial entities play a dominant role in price movement. Because of their size, these participants cannot enter or exit positions randomly. Their activity leaves identifiable patterns on price charts.

Instead of predicting the market, SMC traders analyze how price reacts around areas where institutions are likely active. This includes zones of accumulation, distribution, and liquidity collection. The goal is to trade in the same direction as these participants rather than against them.

Smart Money vs Retail Trading Behavior

Retail traders often enter trades based on indicators, patterns, or emotional reactions. Institutions, by contrast, focus on execution efficiency, liquidity availability, and long-term positioning. The SMC trading strategy attempts to bridge this gap by teaching traders how to read institutional footprints rather than retail signals.

This does not mean institutions manipulate the market at will. In many cases, they simply need liquidity to execute large orders, which naturally leads to price movements that can appear aggressive or deceptive to unprepared traders.

Core Principles of the Smart Money Concept

Understanding the SMC trading strategy requires familiarity with several core principles. These concepts work together and should not be used in isolation.

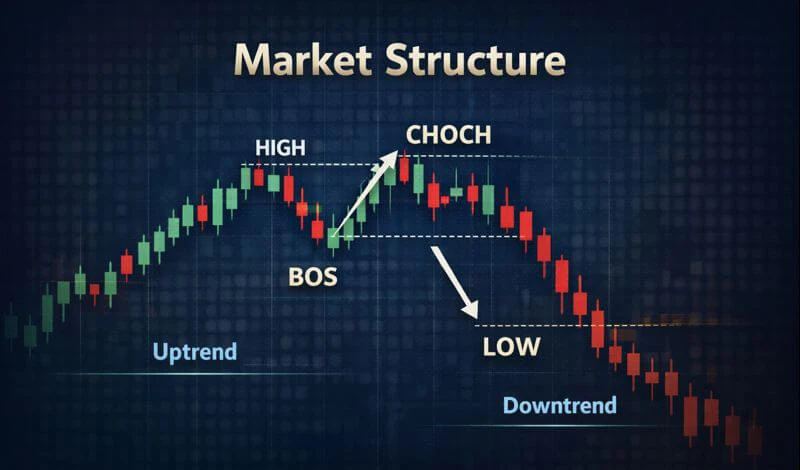

Market Structure

Market structure describes how price forms highs and lows over time. In SMC, structure is used to define trend direction and potential trend changes.

An uptrend is defined by higher highs and higher lows. A downtrend consists of lower highs and lower lows. When this sequence changes, it signals that smart money may be shifting its bias.

Liquidity

Liquidity refers to areas where a large number of orders are placed. These are often found above recent highs or below recent lows, where stop-loss orders tend to cluster.

Institutions seek liquidity because it allows them to enter or exit large positions efficiently. Many sharp price moves occur when liquidity is taken, not because the market is random, but because large players require counterparties.

Supply and Demand

Supply and demand zones are areas where price previously reacted strongly. In SMC, these zones often align with institutional order flow rather than simple support and resistance.

Demand zones indicate areas where buying pressure exceeded selling pressure. Supply zones represent the opposite. These zones often overlap with order blocks.

Order Blocks in the SMC Trading Strategy

Order blocks are one of the most well-known elements of the SMC trading strategy. They represent areas where institutions placed large buy or sell orders before a significant price move.

How to Identify Order Blocks

An order block usually appears as the last bullish or bearish candle before a strong impulsive move. For example, in an uptrend, the last bearish candle before a strong bullish rally may be considered a bullish order block.

Traders mark the high and low of this candle and watch how price reacts if it returns to that zone. A strong reaction suggests institutional interest remains.

Types of Order Blocks

There are bullish and bearish order blocks. Bullish order blocks are found in uptrends or after bullish reversals, while bearish order blocks appear in downtrends or after bearish reversals.

Some traders also differentiate between mitigated and unmitigated order blocks. A mitigated order block has already been revisited by price, while an unmitigated one has not.

Break of Structure and Change of Character

Break of Structure (BOS) and Change of Character (CHoCH) are essential concepts in the SMC trading strategy because they help traders determine when market bias is shifting.

Break of Structure (BOS)

A break of structure occurs when price breaks a previous high in an uptrend or a previous low in a downtrend. This confirms that the current trend is continuing.

In practical terms, BOS helps traders stay aligned with momentum rather than trying to catch reversals too early.

Change of Character (CHoCH)

CHoCH signals a potential trend reversal. It occurs when price breaks a key structural level in the opposite direction of the prevailing trend.

For example, in a downtrend, a break above the last lower high may indicate a shift toward bullish conditions. Traders often wait for CHoCH before looking for reversal trades.

Fair Value Gaps and Imbalances

Fair Value Gaps, also known as imbalances, occur when price moves rapidly in one direction, leaving little or no trading activity between levels.

Why Fair Value Gaps Matter

In the SMC trading strategy, fair value gaps suggest inefficient price delivery. Institutions often revisit these areas to rebalance orders.

Traders look for price to return to a fair value gap and then resume the original direction. This can provide precise entry opportunities with defined risk.

How to Trade Fair Value Gaps

Fair value gaps are typically identified using three consecutive candles where the middle candle creates a gap between the first and third. Traders mark this area and watch for price reactions when it is revisited.

FVGs work best when aligned with market structure and higher-timeframe bias.

Liquidity Concepts in SMC Trading

Liquidity is central to understanding why price behaves the way it does in many scenarios.

Buy-Side and Sell-Side Liquidity

Buy-side liquidity exists above highs where buy stop orders are placed. Sell-side liquidity exists below lows where sell stops are located.

Institutions may push price toward these areas to trigger orders and create liquidity for their own positions.

Liquidity Grabs and Sweeps

A liquidity grab occurs when price briefly breaks a high or low and then reverses. This move often traps traders who enter late or place stops too close.

In the SMC trading strategy, liquidity grabs are not random. They often precede significant moves in the opposite direction.

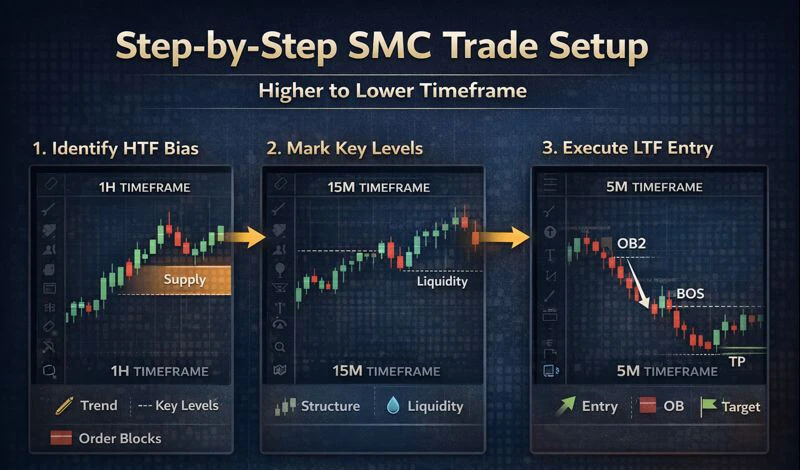

How to Trade Using the SMC Trading Strategy

Trading with SMC involves a structured process rather than isolated signals.

Step 1: Determine Higher-Timeframe Bias

Traders begin by analyzing higher timeframes to identify overall market direction. This includes identifying market structure, key highs and lows, and major order blocks.

Trading in alignment with higher-timeframe bias increases probability.

Step 2: Mark Key Levels

Next, traders mark order blocks, liquidity zones, and fair value gaps. These areas form the framework for potential entries.

Clarity at this stage reduces emotional decision-making later.

Step 3: Refine Entries on Lower Timeframes

Lower timeframes are used to fine-tune entries. Traders look for confirmations such as CHoCH, reactions from order blocks, or taps into fair value gaps.

This approach helps achieve tighter stop-loss placement.

Step 4: Define Risk and Targets

Risk management is non-negotiable. Stop losses are typically placed beyond the structure that invalidates the trade idea.

Targets may be set at opposing liquidity zones or structural levels.

Risk Management in SMC Trading

Even the best SMC trading strategy setups fail. Risk management ensures that losses remain controlled.

Position Sizing

Traders calculate position size based on stop-loss distance and acceptable risk per trade. This keeps risk consistent regardless of setup size.

Managing Expectations

SMC is not a shortcut to profitability. It requires screen time, discipline, and patience. Not every order block or liquidity sweep will result in a winning trade.

SMC Trading Strategy vs Traditional Price Action

SMC and price action share many similarities, but their focus differs.

Price action emphasizes patterns, candlesticks, and support and resistance. SMC emphasizes why those patterns form by focusing on liquidity and institutional behavior.

In practice, many traders blend both approaches rather than treating them as opposites.

Common Mistakes Traders Make with SMC

Many traders struggle with SMC because of unrealistic expectations or poor execution.

Common mistakes include:

- Overmarking order blocks

- Ignoring higher-timeframe structure

- Trading every liquidity sweep

- Using SMC without clear risk rules

- Expecting instant results

Is the SMC Trading Strategy Suitable for Beginners?

Beginners can learn SMC, but it requires a structured learning process. The terminology and concepts may feel complex at first, but they become clearer with practice.

New traders should focus on mastering market structure and liquidity before adding advanced concepts.

FAQs

Is the SMC trading strategy only for forex?

No. The SMC trading strategy can be applied to forex, indices, commodities, and even cryptocurrencies. The principles of liquidity and market structure are universal.

Does SMC work on all timeframes?

Yes, but higher timeframes tend to produce more reliable signals. Lower timeframes are often used for precise entries rather than directional bias.

Is SMC a guaranteed way to make money?

No trading strategy guarantees profits. SMC provides a framework for understanding price behavior, but outcomes still depend on execution and risk management.

How long does it take to learn SMC?

Learning the basics may take weeks, but developing consistency can take months of practice. Screen time and journaling are essential.

Do I need indicators for SMC trading?

Most SMC traders rely primarily on price action. Some use volume or session tools, but indicators are not required.

Can SMC be automated?

SMC relies heavily on context and discretion, which makes full automation difficult. Some elements can be coded, but human judgment remains important.

Volver Volver